Best Financial Advisors for Investment in Delhi

What is a Financial Advisor? (Best Financial Advisors for Investment in Delhi (SEBI Registered)

What is a Financial Advisor? (Best Financial Advisors for Investment in Delhi (SEBI Registered)

For a fee, a financial advisor or financial planner gives consumers financial guidance or counsel. Financial advisors (sometimes spelled advisers) can help with a variety of services, including investment management, tax planning, and estate planning.

Financial advisors are increasingly operating as a “one-stop shop,” offering everything from portfolio management to insurance products. We have financial advisors for our financial difficulties, just as we have doctors for our medical ones.

If you are in and around Delhi then look for Best Financial Advisors for Investment in Delhi (SEBI Registered)

Difference between a financial planner and a financial advisor?

Difference between a financial planner and a financial advisor?

A financial advisor is someone who can assist you manage your money and answer any questions you may have about money.

A financial planner is someone who focuses on financial management in more depth. They may sometimes entirely handle someone’s financial portfolios and offer proactive suggestions to their customers.

If you are in and around Delhi then look for Best Financial Advisors for Investment in Delhi (SEBI Registered)

Do we need a financial /investment advisor?

Do we need a financial /investment advisor?

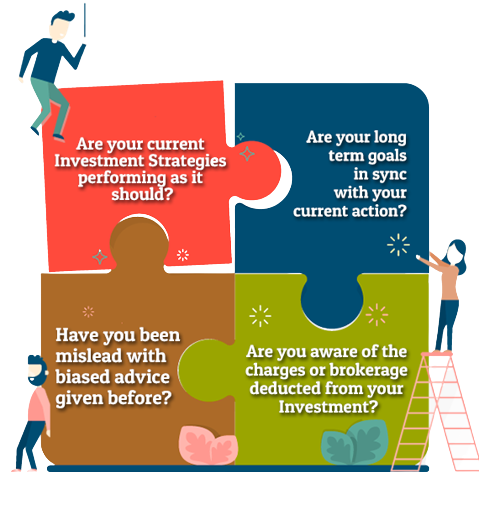

Money management is the process of identifying potential strategies to boost the returns on your portfolio. This comprises substantial duties such as changing your maturities, experimenting with innovative investing tactics, and expanding your company’s reach into the worldwide securities market. However, among all of these and many more potential possibilities, the return and risk picture may not always be obvious. As a result, evaluating and implementing one or more of these techniques might be difficult at times.

A financial/investment adviser is often hired to save time, boost convenience, and minimize stress.

The fundamental rationale for employing an independent financial/investment adviser is the client’s expectation that the investment would result in an increase in net returns. However, there is no assurance that an investing professional will always provide positive returns. If you are in and around Delhi then look for Best Financial Advisors for Investment in Delhi (SEBI Registered)

Is it worth using a financial advisor?

Is it worth using a financial advisor?

A financial advisor may bring value to your efforts to enhance your money in a variety of ways. Among these are:

- Financial planning

- Asset allocation

- Tax planning

- Rebalancing

- Withdrawal timing

Guidance on these areas may increase your results incrementally or significantly. It all depends on your specific situation.

However, the single most important method an adviser may offer value and boost net returns is through a process known as “behavioral coaching.” 3 This sort of advise might help you reset your thinking about the market and act calmly even during turbulent times.

If you are in and around Delhi then look for Best Financial Advisors for Investment in Delhi (SEBI Registered)

Are financial advisors only for rich people?

Are financial advisors only for rich people?

A common misperception is that financial planning is reserved for the rich. The fact, however, is that financial planning may assist anyone build money.

The purpose of financial planning is to assist people achieve their chosen life objectives. Experts claim it doesn’t matter when you start or how much money you have. All that counts is that you reach your ultimate objectives.

If you are in and around Delhi then look for Best Financial Advisors for Investment in Delhi (SEBI Registered)

Is it worth paying a financial advisor?

Is it worth paying a financial advisor?

Many people ask if it is worthwhile to hire a financial advisor. Are they truly worth the time, money, and trouble? It may be a significant investment, and you don’t want to make mistakes or feel uneasy about the procedure.

If you determine you may benefit, it is critical to select an adviser who is not just knowledgeable, but also suited for YOU and YOUR requirements.

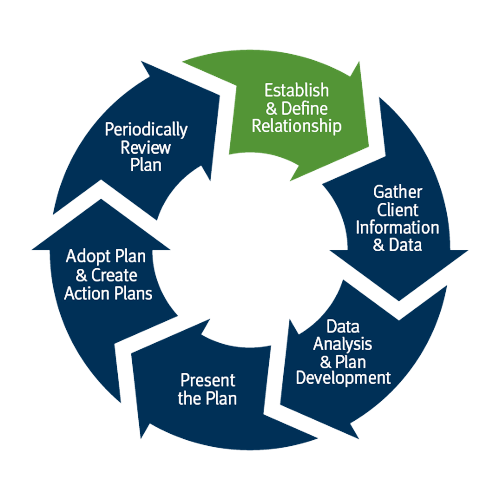

Creating a long-term financial plan and an overall financial strategy to achieve your goals with the assistance of a financial advisor

Confirmation that what you’ve been doing on your own is sufficient

Development of an investing plan (but enabling you to make and manage the investments).

Creating an investment strategy and actively managing those investments. Behavioral coaching to assist you really accomplish what you should be doing. Reducing tax costs.

If you are in and around Delhi then look for Best Financial Advisors for Investment in Delhi (SEBI Registered)

How to Choose the Best Financial Advisor in Delhi?

How to Choose the Best Financial Advisor in Delhi?

There are many people claiming to be the finest financial advisor in India. They promise to provide bigger returns and even go so far as to guarantee it.

The most crucial factor to consider while selecting and hiring the Best Financial Advisor in Delhi is whether or not he or she is a SEBI Registered Investment Advisor (RIA). If you are in and around Delhi then look for Best Financial Advisors for Investment in Delhi (SEBI Registered).

If your are looking for Best financial planning for Retirement planning in India, child education plan or best Tax consultants in Delhi (NRI Services) then find us on Google.

The Bottom Line

The Bottom Line

Because they may assist you with numerous complicated financial decisions throughout your life, good financial advisors and planners are compared to life coaches. A financial adviser can assist you buy a car, save for education, and refinance your house mortgage. They interact with other financial experts on a regular basis and will usually know whether you’re overpaying for something or not obtaining a competitive rate.

Great financial planners will not only assist you in making money on your assets, but will also assist you in reaching your goals, avoiding unnecessary investment risks, saving money on insurance, and achieving other significant financial milestones. If you are in and around Delhi then look for Best Financial Advisors for Investment in Delhi (SEBI Registered). If you are looking for Tax consultants in Delhi (NRI Services) then we will surely be right choice for you. If you are looking for Mutual Funds in Delhi then look out for Top Mutual Fund Advisor in Delhi

Pingback: How beneficial it is to take Financial Advisor guidance for Investing and Tax Planning?

Pingback: Retirement Planning in India : Top Financial Options - Blog Prosperidhi